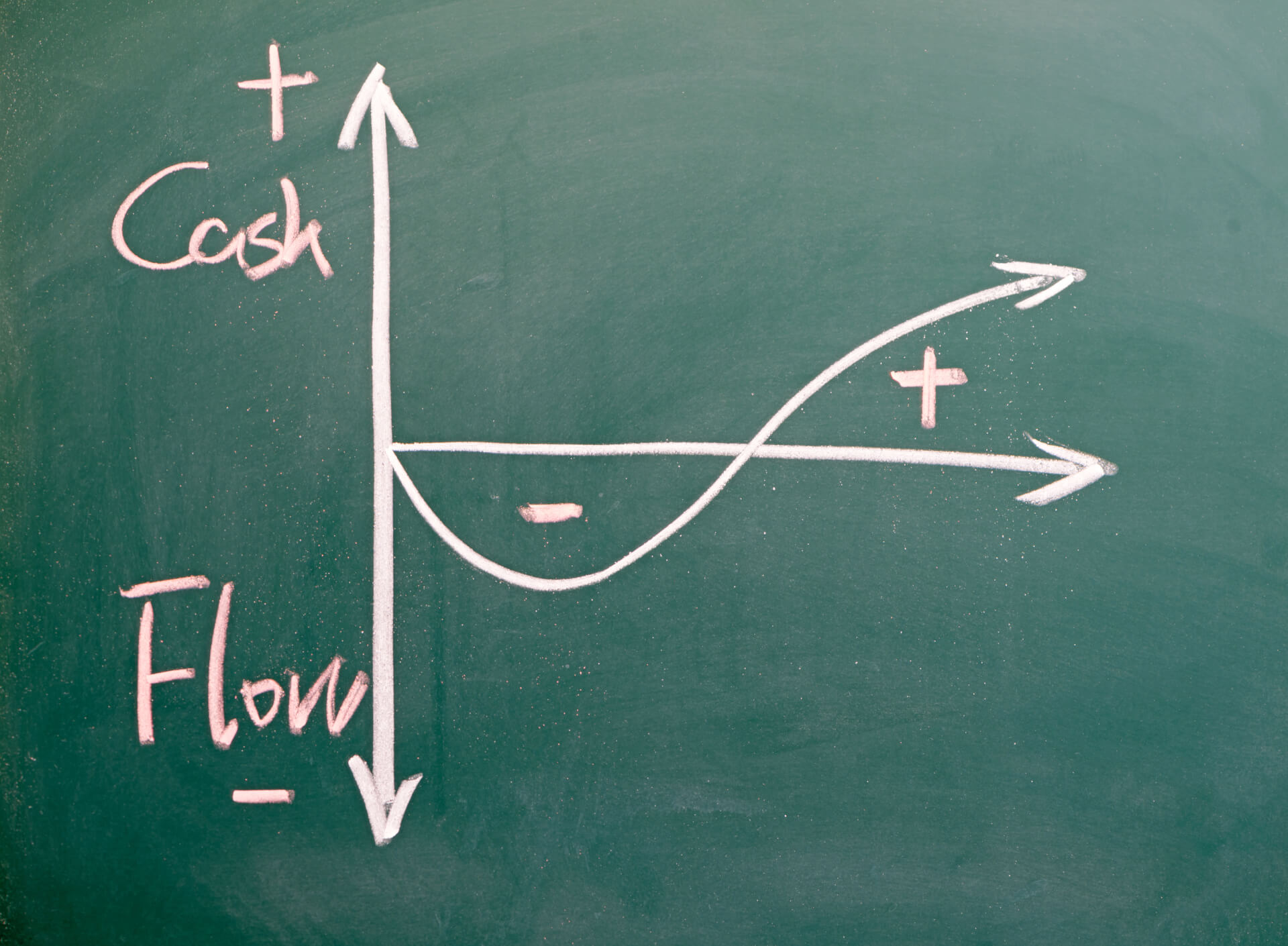

It doesn't matter how great your product or your marketing might be. The foundation of success for businesses, and the reason why some don't make it, is cashflow. The moment you don't have the money in the bank to pay your staff, suppliers or tax bills, you could be in big trouble. Cashflow planning helps you to see this coming, giving you time to take action.

Cashflow planning is essential

It's much more comfortable when you have consistent, positive cashflow. There are no moments of panic when you fret over how you'll pay a particular commitment. You have more time to plan ahead, to have an eye on the future rather than worrying about today.Consistent, positive cashflow doesn't just happen. Being profitable doesn't guarantee that your business will always have the cash to meet your commitments. Income from sales doesn't always flow in fast enough to cover payments you need to make. Achieving a steady cashflow requires planning. It starts by making a cashflow forecast.

Prepare a cashflow forecast

A cashflow forecast is a plan of the money your business expects to receive and to pay out in the near future. It helps you to predict how much money will be in your bank account at any point in time. A cashflow forecast is usually broken down into months or weeks to make it easier to plan.To construct your cashflow forecast you'll want to use a spreadsheet or a cashflow planning tool. Your accounting system can provide useful information about your past cashflow but it's not so helpful for predicting the future, because it's based on transactions that have already occurred.The benefits of preparing and maintaining a cashflow forecast include:

- You have better control over your business finances.

- It helps you to make realistic decisions about spending.

- You can plan for the future more easily.

Your cashflow forecast is just that - a forecast. The reality will turn out differently, although a well-prepared forecast won't be that far off what actually happens.

Use a forecast to make better business growth decisions

Growing a successful business requires you to make choices. If your business model is sound it's likely your business will expand naturally, at least in its early days. However, it won't be too long before the rate of growth levels off, as you've satisfied the initial levels of demand. Maintaining growth, or restarting it, requires decisions and actions that will bring in more customers and extend your opportunities to earn more revenue.Your cashflow forecast will help you to assess the impact of these decisions. It allows you to model what's likely to happen in the future, as you incur more costs with the objective of growing sales.The forecast will help you determine the costs and benefits of actions such as:

- Launching a new marketing campaign.

- Taking on a new member of staff.

- Selling a new product.

- Purchasing new equipment.

- Expanding into a new geographical area.

- Raising additional working capital.

Forecasting requires making some estimates about likely future income based on your choices.

How to build a cashflow forecast

Whatever tool you use to build your forecast, it will have three basic sections. These are:- Incoming cash

- Outgoing cash

- The net balance

Step 1 - Incoming cash

This section is a list of your different sources of income. Depending on how you sell, you may want to break this down into different categories based on the type of income, such as cash sales, credit sales, credit card settlement and the like.Not all incoming cash is from sales. You may also receive cash from loans, equity investments, tax refunds and other sources.

Once you've completed this section, you should have a clear idea of how much money you expect to receive on a weekly or monthly basis, over the period of the forecast. Typically, a cashflow forecast will look six months to a year ahead, and longer for bigger projects.

Step 2- Outgoing cash

In the same way, list all the payments made from your business. Be sure to include every form of payment, and take care to include irregular or annual payments. To help you check that you've not missed something, take a look at your accounts for the previous year to see what payments were made.Payments you're likely to have in this section include:

- Stock purchases

- Payroll

- Tax payments

- Loan repayments

- Asset purchases

- Expense reimbursements

Once you've completed this section you should have a total for the cash outgoings on a weekly or monthly basis.

Step 3 - Net balance

The net balance is the difference between the total incoming cash and the total outgoing cash. If you add your opening bank balance, the cashflow forecast will now give you an estimate of how much money you will have in your bank account on any particular day.In a strong, healthy business the net balance should be positive. If it's not, the forecast will help you to identify the reason. It may be that you're investing in business growth, which will bring in more future sales income but involves advance costs. The forecast will help you identify whether you need to source short or medium-term funding from elsewhere, and the scale of that funding.

Common problems with cashflow forecasts

Errors occur in cashflow forecasts because the process involves making estimates and it often relies on data that's input into a spreadsheet manually, rather than taken directly from your accounting system.Problems to look out for in your cashflow forecast include:

- Overlooking VAT on sales, purchases and tax payments.

- Inaccurate information about future receipts and payments.

- Big differences between actual and estimated sales.

It takes time to build and refine an accurate cashflow forecast. Don't be surprised that you need to alter yours often, adding in unexpected receipts and payments.

Keep your forecast up to date

Because your cashflow forecast is based on estimates and assumptions, it will very quickly differ from what actually happens. This means you should update it regularly and often. A well-run business will maintain their cashflow forecast several times a week, perhaps even daily, to keep it as accurate as possible.Cashflow planning is a vital business activity that you can't afford to overlook or put off. If you're planning to grow your business successfully, the time you put into cashflow forecasting is a wise investment.

Ethical business funding from Qardus

We support growing businesses by providing growth finance of between £50k to £200k on terms of between 6 and 36 months. This finance is helping UK-based small and medium-sized companies to expand their operations and their market share.We fund businesses that have demonstrated their capability with a proven product and management team. Our clients are drawn from many different industries, but our ethical position means we cannot work with companies involved with products considered detrimental to the welfare of society, such as gambling, alcohol and tobacco. This is because we operate based on Islamic community principles. Our funding process is certified as Sharia-compliant.

We work with businesses and their owners both inside and outside the Muslim community. Any business that operates in line with our ethical values is welcome to apply for funding.

If your business is looking for growth funding that's fast, affordable and ethical, get in touch with us today.